Chances are pretty good…

If you only looked at my resume or maybe my LinkedIn profile – varsity athlete, professional artist, innovator, corporate bigwig, recipient of an award from a sitting Vice President of the United States, a successful serial entrepreneur in now six different industries, and author of bestselling books in multiple categories – you might say to yourself:

“Wow this guy’s led a charmed life”.

And because I mentor lots of adults who are generally closer to the beginning of their careers than the end, after our first meeting, I sometimes get the joking statement of:

“Wow, I wanna be you when I grow up”.

My answer is always the same.

No. You really, really, really don’t.

And of course, when I’m asked why I say that, I give them the brief history of John, which since you’re here, I will recount to you now.

I wanted to be an artist since I was six years old.

And my parents always encouraged me to do so, so I did well in school, i.e. always good grades, varsity athlete, all the honor societies, while honing my art skills and as a result I got offered a few college scholarships. Which, much to the dismay of my father I turned down to go instead to the Cleveland Institute of Art. And for those of you who are not aware the Cleveland Institute of Art is not an inexpensive school to attend, nor is it an easy school because on top of a fully accredited liberal arts curriculum you’re required to spend 6-8 hours a day in a studio making art so as a result the program is five years rather than the typical four.

My family was not even remotely close to being rich, and student loans were not a thing yet, so in order to pay for that choice my father arranged for me to get a job where he worked for 34 years of his life, in the now long gone steel mills of Republic Steel. I learned then and there that was not the life I wanted to have.

I studied to be a portrait painter.

And when I graduated in 1979, I had several portraits already lined up and I made quite a bit of money. I lived and worked in a huge warehouse loft in a downtown Cleveland (Ohio) area known as The Flats, waaaay before it was popular and I very much enjoyed that time and space. However, in 1982 when the economy went South, my income dried up and I learned that I like to eat at least once on a daily basis.

Fast forward a little bit and strangely enough at age 25 I bought a strip club. When I mention that most people think:

“Wow, a good looking 25-year-old guy owning a strip club? You must have been like a kid in a candy store”.

Um…no.

The place I bought was a grimy little bar in a low-income part of town that had ugly dancers and was frequented by a Hells Angels rival biker gang, the Descendants. People thought I was nuts. But I had a plan. About a year later I shut it down, expanded it, remodeled the whole place, changed the name and turned it into a very successful disco dance club.

Money flowed in.

Shortly after that project was completed, I moved from the warehouse district to a double house built in the 1930’s just a few streets down from my nightclub and immediately set out to renovate it to turn it into both a living space (upstairs) and art studio (on the first floor).

The following January, on one of the coldest nights in the city of Cleveland, with wind chill readings in the negative double digits, while I was at my bar down the road, my house, along with all my artwork stored inside it…burned to the ground.

Neighbors told me that the upstairs room where I had stored hundreds of drawings, several large paintings, along with cans of turpentine, mineral spirits, oil paints, pencils, brushes, linseed oil, rolls of canvas and paper and various other flammable material (out of harm’s way so I thought) while I gutted the downstairs, basically blew up.

I was initially accused of arson because the Fire Marshals immediately knew that there was some incendiary material involved.

As it turned out the fire was likely started by one of my cats knocking over a (not-exactly-safe) coiled wire electric heater that was made in the 1940s which I was using downstairs to keep some exposed water pipes in an internal wall from freezing on nights like that.

Needless to say, I was devastated.

A big part of how I identified myself was gone. Up in smoke, literally. I did not pick up a pencil or a paintbrush to create any form of art for the next 20 years.

I consoled myself by becoming a party animal. I drank too much. I got involved with drugs and after a couple other ventures in that industry I realized that if I carried on that lifestyle I would be dead by the time I was 40 so, fast forward again, I got out of the bar business and started a magazine with some partners in Cleveland called Spotlight Entertainment Magazine.

Money flowed again.

That business sold a couple years later and after some seriously bad investments on my part I went bankrupt in 1989.

Oops.

While my credit was recovering, I spent the next 11 years in the corporate world at the regional telephone company Ameritech’s advertising HQ in Troy, Michigan. I parlayed my creativity to jump some rungs on the corporate ladder to become Senior Director of New Product Development for that company, as well as Chairman of a consortium of all the Yellow Pages publishers across the US, called the Direct Delivery Network. I invested in some real estate.

Money flowed yet again.

I got married along the way and it was there that I became the first civilian to receive something called The Hammer Award from then Vice President Al Gore (in 1996), for a project that we had done in partnership with the Federal Government’s General Services Administration (GSA) to redesign the Federal Government listings that appeared in the Indianapolis and Chicago area Ameritech directories.

If you’re not familiar with what the Hammer Award was, it was created after Vice President Gore appeared on the Late Night Show with David Letterman and announced that he was getting rid of ‘all the waste and expense in the federal government’ by doing away with things like a ceramic ashtray (which he brought with him) that you could easily buy anywhere at the time for about a dollar, but for whatever reason cost the government $500 simply to add the White House insignia. He demonstrated how he was going to get rid of that expense by smashing that ashtray with a hammer on live TV. The award it turned out, aside from little hammer lapel pins, was in fact, a $6 hammer, glued to a framed piece of poster board with a notation about what the award was for.

Obviously, one of the first cutbacks was in the awards department.

Company guy that I was, after speeches made by Presidents of two divisions of the company that had absolutely nothing to do with the project, I gave the actual award to my boss, an Ameritech Advertising Vice President (who liked to take credit for everything we did anyway) who was promptly detained at the Washington DC airport for trying to board the plane with a weapon – that $6 hammer.

Ya gotta love Karma.

He later fired me – when he found out I had planned, rather than move with my new product team to St. Louis when Ameritech planned to merge with Southwestern Bell Company in 2000, instead to join a former colleague with an HR software startup called Peopleclick (now renamed Peoplefluent), in Raleigh NC. I was forced to sue for wrongful termination and eventually won the more than a quarter million golden parachute I should have received (of course a third went to my attorneys, but a win is a win), however, I would tell anyone to think long and hard about doing something like that if they plan to continue in any corporate environment. Big companies don’t like people who litigate!

During my brief tenure at Peopleclick, which I helped grow in recurring revenue from $1 million in 1999 to $42 million in 2001, I made more money than I ever had in my life.

But I also went through a world class ugly divorce.

How do I define ‘word class ugly’? Well, let’s just leave it at the fact that some years later I was featured, along with Elon Musk’s first ex-wife Justine (before he was a billionaire) and another couple guys that were way richer than me, in a CNBC documentary called “Divorce Wars”.

Yeah…there’s that. If you want to completely derail any retirement plan you have, get divorced. I can laugh about it now, but it was no fun at the time.

However, at the absolute worst point of that adventure, I wondered to myself:

“Why isn’t there insurance for this?”

And that became the “aha” moment for the creation of my next business venture, Divorce Insurance.

I entered the financial services industry in the fall of 2001, on the sly, intent to learn why something that seemed so sensible had never been done before. Once we figured out it how could be done profitably, there were dollar signs written all over it. SafeGuard Guaranty Corporation was founded in 2005. I sank in every penny I had and we raised a ton of money beyond that and Wedlock Divorce Insurance was introduced in 2010. I became a fairly well known innovator and influencer in the insurance industry and a fervent consumer advocate.

That incredible roller coaster ride ended in a brick wall.

With the stroke of a pen, Marriage/Divorce insurance policies and SafeGuard Guaranty Corporation was literally regulated out of business. Meaning outlawed in the United States.

Turns out that the big dogs in the insurance industry have a lot of influence with the National Association of Insurance Commissioners and they don’t like It when a new product comes along that threatens to carve up their cash cow and eat away at their potential customer list.

Uh oh.

With the change of two super obscure insurance laws that factually impacted no other insurance company but mine, I lost more money than many people make in a lifetime and I was forced to go back into selling life insurance to support my now second wife and family.

Don’t get me wrong. Selling Life Insurance is not a bad gig, especially if you like helping people, it’s actually quite lucrative if you work at it, but being up to my eyeballs in debt due to a business failure was not what I had planned at age 55.

It’s here that I’ll mention that I have a very personal relationship with God. He likes to present me with incredibly overwhelming challenges and my general response over the years has been:

“Oh yeah? Watch this.”

Aside from what you’ve already learned about me, around age 35 I started to notice a loud ringing in my left ear. No doubt as a result of standing next to speakers taller than me (6 foot) both at my nightclubs and at side gigs I did at rock concerts. By age 40, hearing in my left ear was effectively the equivalent of a non-stop digital e-flat sound and nothing more. But my right ear was fine.

Then in 2019, my right ear went south. Like to Brazil south.

Literally overnight I went from being able to hear fine to having everyone’s voice sounding like Charlie Brown’s mother in the cartoons. Strangely, I could hear our cat’s meow just fine. I could hear the squeaky board on our bedroom floor and other familiar noises seemed to sound normal. It turns out that where I initially went deaf was between 4000 and 8000 megahertz – which is exactly where the human voice resides.

Needless to say, for a guy whose income at that time was 100% dependent on being able to listen to other people’s needs, going deaf is not a good thing. Quite frankly I was terrified. And I was a little angry with God about this most recent practical joke. Add to that my then wife (apparently having no regard for the ‘for richer or poorer’ part of our wedding vows) telling me no one would ever read any book I was preparing to write, now saw me as a liability rather than an asset and promptly kicked me to the curb.

Divorce number two was less financially damaging.

But likely only because in trying to keep SafeGuard Guaranty afloat years before, about the only asset I had that wasn’t encumbered by some sort of debt was my 40 acres in western Utah that I had affectionately named Rattlesnake Ranch because that’s about the only living thing that is there all year. Thankfully she didn’t want any part of that.

Like acquiring any disability, going deaf makes you re-examine a lot of things.

And losing your ability to generate a living wage being not far from the top of that list. So, I decided early on to condense much of what I had learned over my 20 years as a deep insider in the Financial Services industry into a book that I hoped would serve two purposes:

A) to generate some much-needed income; and B) to teach people younger than myself (aiming specifically at people like my Millennial aged son) some much needed financial literacy, as well as provide a step by step battle tested method to make sure they never run out of money when they reach retirement age, like so many of my fellow Baby Boomers have, all with zero risk of loss.

I am thankful that my second ex-wife was wrong.

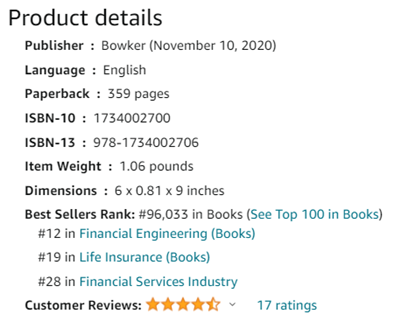

My first book, The Millennial Money Tree – How to (literally) Insure Financial Security in Your Golden Years, when it was published at the end of 2020 became a near instant best seller, #1 in three categories on Amazon at various times during its tenure as a new release. For the better part of two years, it remained generally in the top 100 in its target market categories, often in the top 25.

Coincidentally, the day I originally wrote this blog post (6/25/22), having updated it since, that book’s overall ranking on Amazon was #96,033 and #28 in the Financial Services Industry category.

While those numbers don’t mean anything to anyone unfamiliar with how book rankings on Amazon work, I’ll put things in perspective for you. Amazon won’t say exactly how many books are in the Financial Services Industry category, but if you search that category online the first page will say something like “showing 1-12 of over 2,000 results for Financial Services”, so obviously there are over 2000 titles in that category, but we’ll use 2000 for simple math. That means a rank of #28 in that category is just shy of the top 1%. Not bad for a first-time self publisher with a zero dollar ad budget.

On a broader scale, there are 48.5 million plus books available overall on Amazon and while the rankings change hourly based on book sales, anytime an author can achieve a ranking under 100,000 means that title, that book, is in the top 0.19% of all titles. In other words, my book occasionally sells better than the top 20% of the top 1% of all the other books on Amazon. With zero advertising anywhere.

I’ll give credit to my English teachers at Brooklyn High School for that. 😉

The third edition of The Millennial Money Tree is now available – updated with all new info for 2025.

My second book, Words of Love – 38 Poems & An Essay, a book of love poems I had written over some 25 years did nearly as well when it was released in February of 2022 and also was a #1 new release for several weeks. It has since gone into the thousands in terms of individual category ranking only because there are literally hundreds of titles in that category released weekly. It consistently sells a few per month, but other poets are apparently far more prolific than I.

So that takes us right up to the present. My hearing got worse and I got a cochlear implant on my left side. After not being able to hear on that side for 25+ years, my brain took some time to get used to it, but for anyone with severe hearing loss, I highly recommend it. It truly is a game changer in terms of communication.

Today, I’m taking yet a new path and working to grow my Financial Literacy Mentoring efforts to teach others how to achieve the goal of financial independence and create generational wealth and I hope you’ll join me on that journey. It would be my honor to watch you achieve that.

Having been a poster child for what not to do, is almost as valuable as knowing how to quickly get back into money…almost. I can teach people how to quickly recover from financial disaster because, well, been there…done that.

I’m busy working on a follow-up to The Millennial Money Tree, the working title being The New American Dream – Financial Independence, along with creating several passive income streams and investments in very specific types of equities and cryptocurrencies, because I am now a zealous follower of Warren Buffet’s two rules of investing:

1. Never lose money

2. Never forget rule #1

The Divorce Insurance business is also rising like a Phoenix from the ashes – in a different part of the world that I can’t disclose just yet – still in stealth mode to keep potential competitors from a snatch and grab, but I’ll most certainly update this again once it launches.

Also, once again turning lemons into lemonade, I now have a project in the works to turn about 1/3 of the Rattlesnake Ranch property (that ex #2 thought was worthless) into a solar farm which will generate a nice tidy sum from the Rocky Mountain Power company automatically, every month, probably for at least as long as the rest of my life. And maybe some portion of the rest into a totally off-grid AirBNB (a surprisingly popular type of vacation camping) for even more passive income.

My point of mentioning all that is not to brag about how I overcame disability and massive debt, or even how I see opportunities where others see problems, but instead to impress on anyone who may listen to me that too often when you see advice given by some celebrity or influencer on how to be successful ‘just like them’, that advice is tainted with what is known as “Survivorship bias”.

I mention that in my book and rather than try to paraphrase what that is, below is the description that you find in Wikipedia under the heading of highly competitive careers.

Whether it be movie stars, or athletes, or musicians, or CEOs of multibillion-dollar corporations who dropped out of school, popular media often tells the story of the determined individual who pursues their dreams and beats the odds. There is much less focus on the many people that may be similarly skilled and determined but fail to ever find success because of factors beyond their control or other (seemingly) random events. This creates a false public perception that anyone can achieve great things if they have the ability and make the effort. The overwhelming majority of failures are not visible to the public eye, and only those who survive the selective pressures of their competitive environment are seen regularly.

If I didn’t know better, I would say that description is a perfect excuse for anyone to give up on doing what they love because they seem to fail more than they succeed.

It is not.

Unbeknownst to me, I spent most of my life following an ages-old Japanese ideology called ikigai. A combination of the Japanese words “iki” (生き), which translates to “life,” and “gai” (甲斐), which is used to describe value or worth; ‘ikigai’ is all about finding joy in life through purpose. But that often takes effort, and grit, and persistance. And sometimes, fearlessness…but definitely a lot of persistence.

In fact, on my wall in front of my desk is a quote by then President Calvin Coolidge that I use as a kind of affirmation. It reads:

Nothing in this world can take the place of persistence. Talent will not; nothing is more common than unsuccessful me with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan “Press On!” has solved and will always solve the problems of the human race.

In othe words, if you want to succeed in life, you must learn to persevere. And sometimes that means maybe you change horses in midstream to keep from drowning. You must become a survivor. Like me.

And, while I went from one industry to another to another and so on, it turns out my joy, my ‘purpose’, has always been the same, I just didn’t realize it until later in life.

Whether it was making new art, new nightclubs, new magazines, new products, new software, new insurance policies and always new teams to help me, it’s now pretty obvious that I was always creating. When I say I’m an artist or I’m a writer, it’s not just what I do, it’s who I am…a creator.

I never imagined I would write a best-selling book on personal finance until I had to. I hated poetry in high school, but trust me on this one – love changes your brain. If you had told me when I owned my bars that I would go on to become an influential CEO in the insurance industry I would have told you to quit smoking crack.

Things change. Environments change.

Adversity is not dooming.

For almost everyone, failure in life, somewhere, sometime, is inevitable. In fact, in my experience, I’ve learned far more from failures than I did from successes. So much so that I now tell people that I consider the word “FAIL” to simply be an acronym for First Attempt In Learning.

To survive, we learn how to adapt and carry on. And while my theme song would be the Chumbawamba song “I get knocked down” because I always get up again, I hope you’ll learn from me that if you have the right mindset…and the right plan…you’re next to invincible.

I already know you have what it takes to overcome any obstacle that might present itself on your road to becoming financially independent or you wouldn’t have read this far down the page. That alone proves you have the desire to succeed and as one of my blog readers, I aim to at the very least help you on that road to success. If there is ever anything I can do to help, please don’t hesitate to get in touch with me and I’ll do my very best to help you.

To your success.

John Logan